vermont income tax brackets

For tax years prior to 2012 the minimum tax for every tax year whether 12 months or a short period is 250. GB-1210 - 2022 Income Tax Withholding Instructions Tables and Charts.

Vermont Income Tax Vt State Tax Calculator Community Tax

2020 Income Tax Withholding Instructions Tables and Charts.

. 2019 VT Tax Tables. Vermont state income tax rate table for the 2020 - 2021. Subtract 75000 from 82000.

The latest available tax rates are for. Tax Bracket Marginal Corporate Income Tax Rate. Local Option Alcoholic Beverage Tax.

Tax Bracket Tax Rate. Local Option Meals and Rooms. Here you can find how your Vermont based income is taxed at different rates within the given tax brackets.

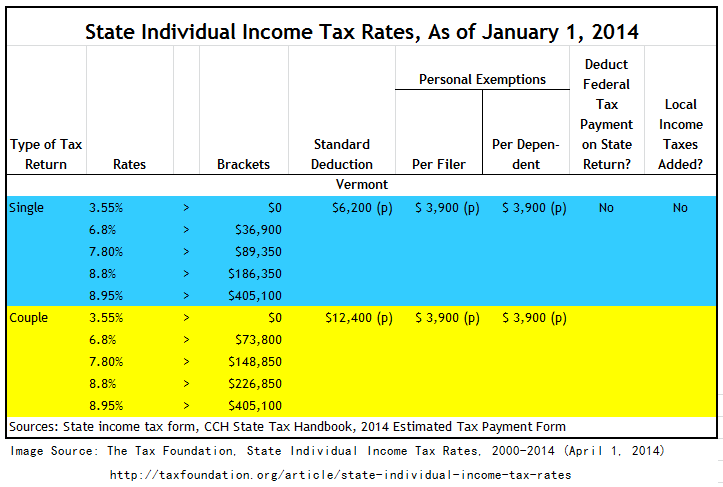

Vermonts income tax brackets were last changed one year prior to 2003 for tax year 2002 and the tax rates have not been changed since at least 2001. 4 rows Vermont Income Tax Rate 2020 - 2021. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

Rates range from 335 to 875. Sales tax or use tax is any tax thats imposed by the government for the purchase of goods or services in the state of Vermont. VT Taxable Income is 82000 Form IN-111 Line 7.

Tax Bracket Single Tax Bracket Couple Marginal Tax Rate. Tax Rate For Single Filers For Married Individuals. Tax Rates and Charts.

Any sales tax that is collected belongs to the state and does. This form is for income earned in tax year 2021 with tax returns due in April 2022. Multiply the result 7000.

6 Vermont Sales Tax Schedule. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Filing Status is Married Filing Jointly.

Small Farm Corporation - Minimum tax of 75 see 32 VSA. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. Base Tax is 2727.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households. 2020 Vermont Tax Deduction Amounts Tax.

We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. 9 Vermont Meals Rooms Tax Schedule. 2019 VT Rate Schedules.

7500 25 Of the amount over 50000. 4 rows Vermont has four marginal tax brackets ranging from 335 the lowest Vermont tax. This form is for income earned in tax year 2021 with tax returns due in April 2022.

13750 34 Of the amount.

4 27 15 The Carolina Cage Match Peter Shumlin Versus Rational Public Policy

How To Update State Taxes In Total Planning Suite Desktop Edition Moneytree Software

Jersey Tax Rate Off 62 Www Scrimaglio Com

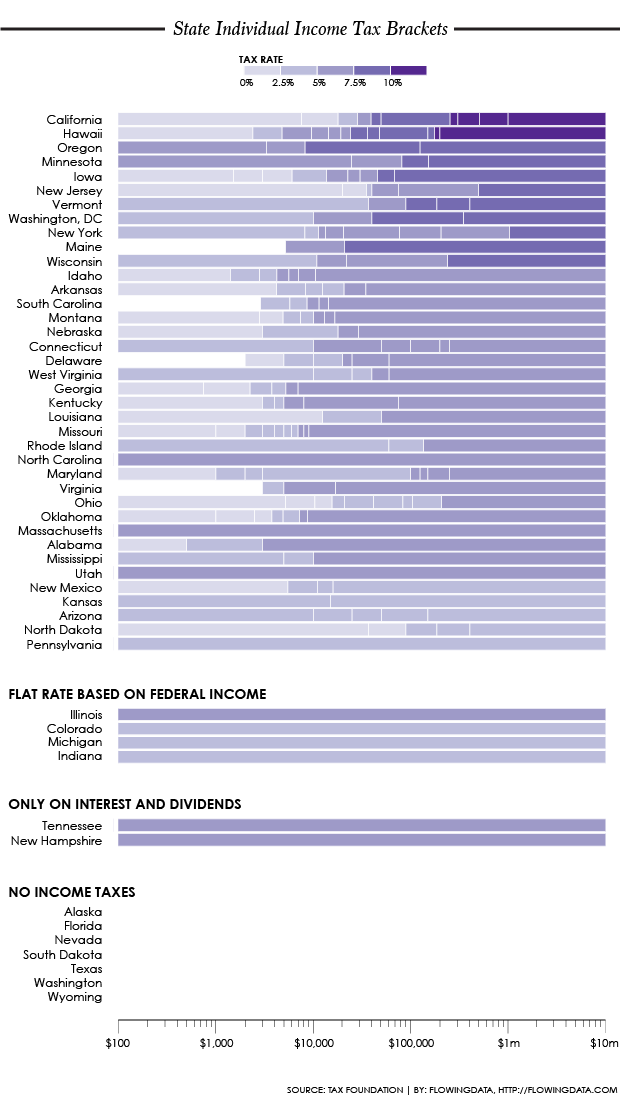

State Income Tax Rates Highest Lowest 2021 Changes

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Vermont Income Tax Vt State Tax Calculator Community Tax

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Paycheck Calculator 2022 With Income Tax Brackets Investomatica

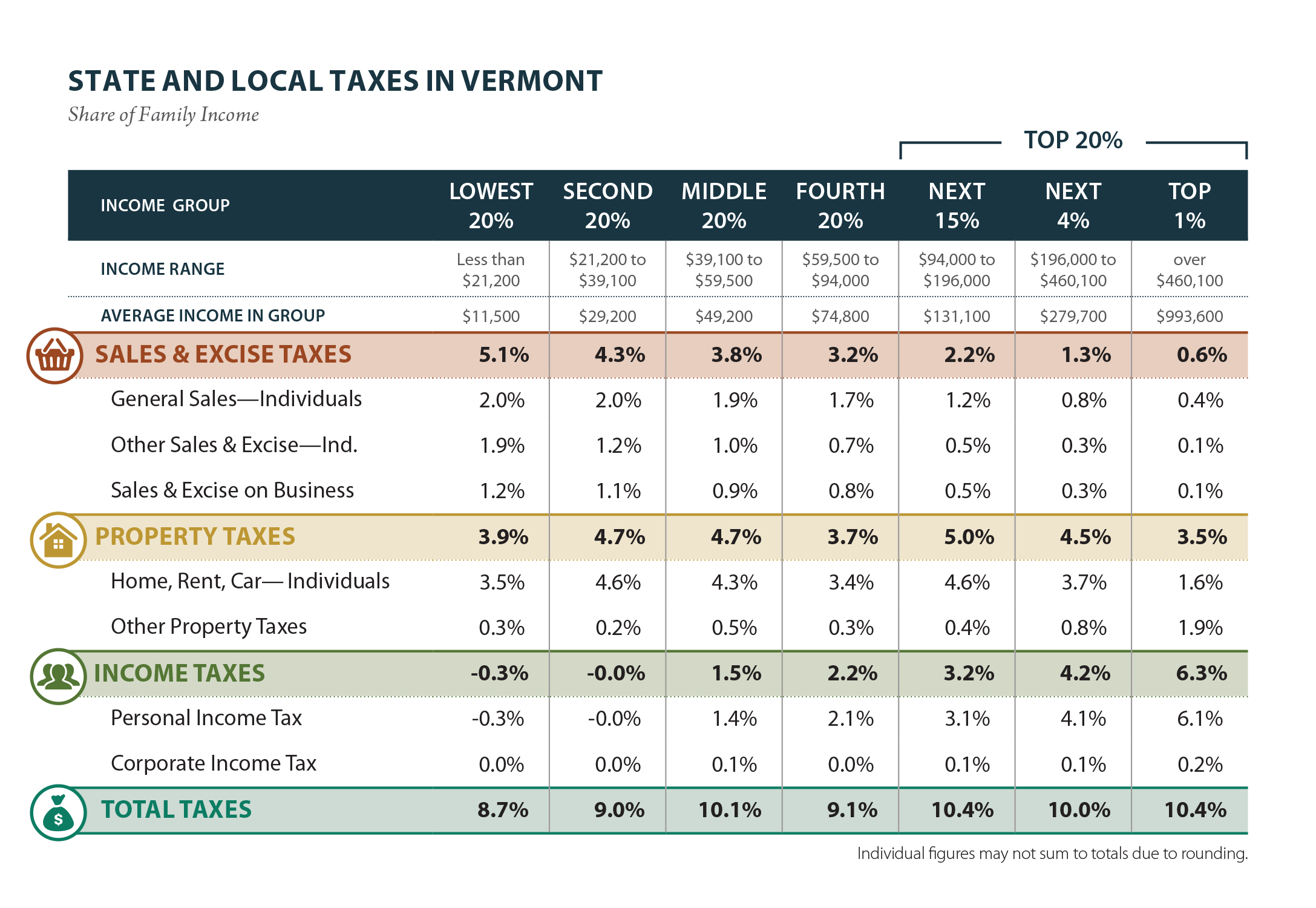

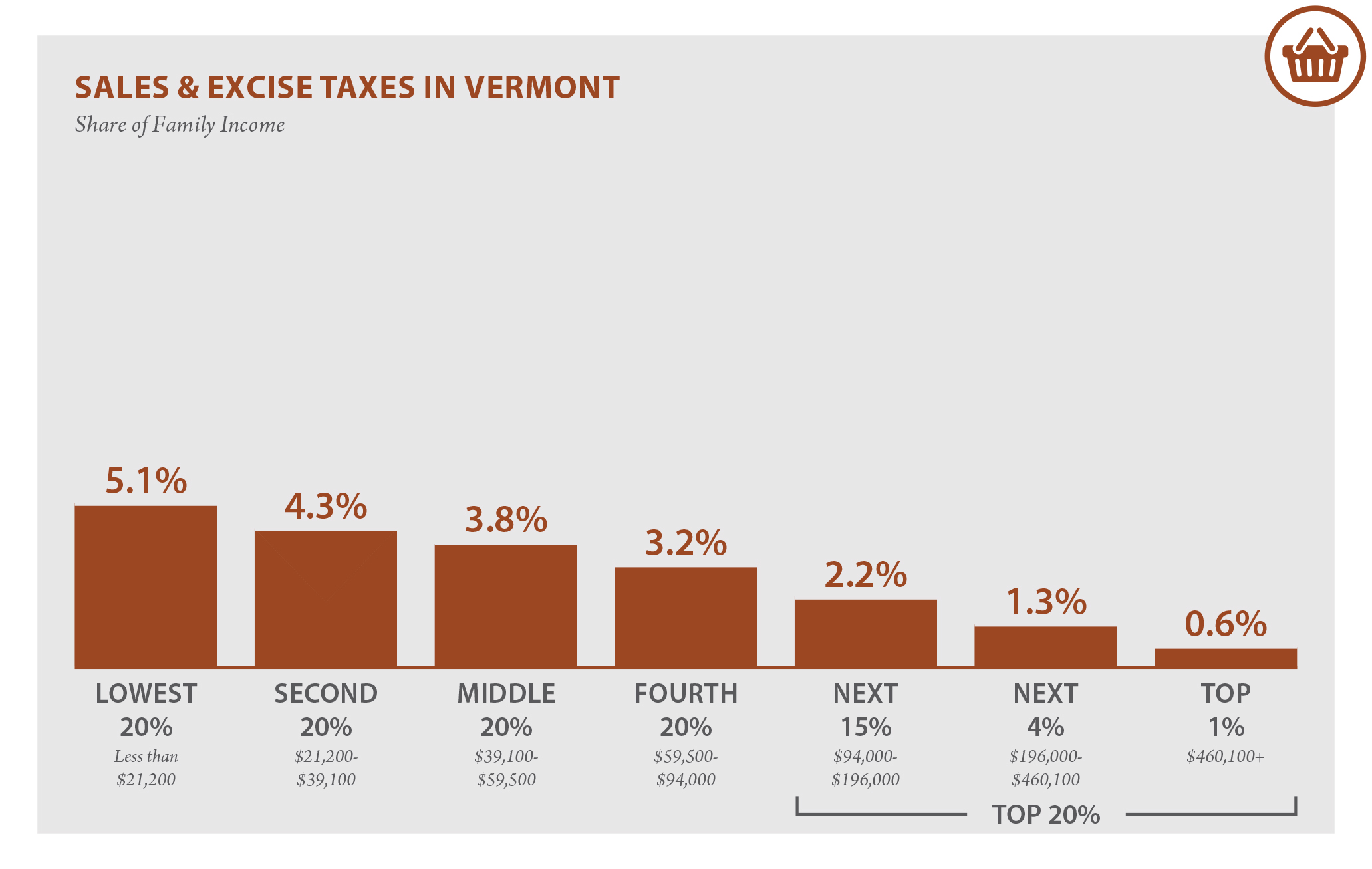

Vermont Who Pays 6th Edition Itep

State Income Tax Brackets Charted Flowingdata

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont Who Pays 6th Edition Itep

Vermont State Tax Refund Vt Tax Brackets Taxact Blog

Can Vermont Follow New Hampshire S Tax Rate Reduction